Have you ever had questions about Social Security benefits? We have answers.

Some areas of personal finance are best learned from experience, some are best learned from personal research. Social Security is best learned in a class where you have the ability to ask a teacher questions.

Join us on August 19th @ 6pm. The instructors at FAAworkshops have taught many Social Security courses and now offer you the chance to attend at home.

FAAworkshops offers a digital class on Social Security benefits that allows you to learn from, and ask questions. Our class comes with:

- 1, 50 minute class on Social Security benefits

- A Social Security workbook to reference before and after the class

- The ability for you to ask questions and get clear answers

- Complimentary, no obligation, 1 on 1 time with the instructor

- Can be done in any format you prefer: phone, zoom, in-person, email exchange etc.

Social Security is the largest pension plan on the planet. If you’re among the 125 million working Americans covered under Social Security, you should learn how the system works. In this workshop attendees will learn how Social Security retirement benefits work. We will cover:

- How your benefit is calculated

- Filing for Married Couples

- Widow/Widower Benefits

- When to take your benefits

Ignoring tuition, just a college textbook to a college class can cost $150.

The all in cost of our class: $9.99 next class August 19th @ 6pm

We firmly believe Social Security is just one of those topics where a teacher is far more helpful than an article or book could ever be. However, because we too like doing research ourselves, we will attempt to provide some quality information to help you understand your benefits right here online. Pardon us in the areas we are overly simple and pardon us in the areas we are too complicated!

The first step in understanding your benefits is to create an SSA.gov account. On this account you will be able to generate a form that looks like the picture on the left. This page contains very useful information for single individuals. On the top right, you will find what is called your primary insurance amount (PIA). This is an estimated number, what social security does is estimate that you will continue to earn an income similar to whatever you made last year, until your full retirement age. In many cases when you plan to work from now until your full retirement age, this number is an accurate estimate. In some cases, such as when you plan to retire before your full retirement age, this proves to be an overstated estimate.

Source: ssa.gov

The second step in understanding your benefits is to find your full retirement age (FRA). Your FRA is based on the year you were born. For example, if you were born in 1957, your FRA is 66 + 6 months. So if your birthday is September 1st, 1957, you will reach your FRA on March 1st, 2024. At this age, you will be eligible to collect your entire PIA.

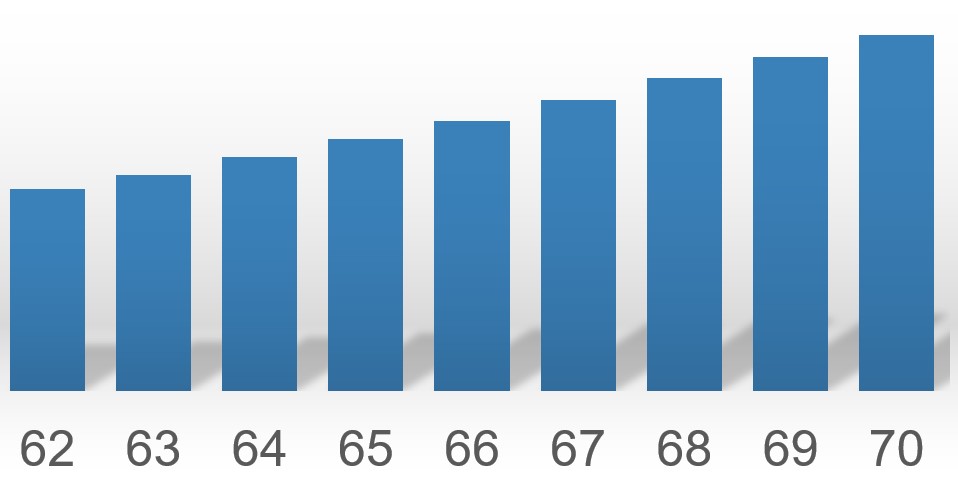

The third step to understanding your benefits is to consider a chart like this. Now this is where things start to get confusing. Again, the courses are the best way to learn and your teacher will be happy to help answer any questions.

You can receive your PIA at your FRA, if you delay filing past your FRA, your annual benefits will go up. If you file for benefits before your FRA, your monthly benefit will be less than your PIA. Your benefits, mapped out based on your PIA, will look just like the chart. Your PIA will be at your FRA. Benefits will fall or rise 8% a year every year you file before or after your FRA. File at 62, you will get the smaller amount, file at 70, you will get the larger amount. In the presentation we can give specific numbers and examples, online, because we have no idea your FRA or benefit amount, it’s a bit tougher! While the appearance of the chart remains the same regardless of your FRA, your FRA will impact how reduced your 62-year-old benefit will be and how large your 70-year-old benefit will be.

The fourth step to understanding your benefits is personal. When do you plan on retiring? Are you married, divorced or widowed? Do you have a pension? Have you created a detailed financial plan which forecasts taxes in retirement? What assets will you leave your loved ones? Social security, while a vital part of any retirement plan, is merely a part of your retirement plan. Looking at it in a vacuum is a mistake many retirees make.

Some more info most retirees, will collect single benefits. Even if they’re married, divorced, or widowed. That’s just how the program typically works out so that’s why we spend most of our time reviewing single benefits. However, if you are married or divorced, you are entitled to half of your spouses (or ex-spouses) benefit up to their PIA, or your own benefit, whichever is greater, but not both. If this is confusing to read the first time, I can assure you, it was confusing for us to read the first time too. Spousal benefits and divorced spousal benefits leave retirees with a more options available to them than single individuals. There are lots of restrictions on spousal benefits but for the most part if you’re currently married, you are eligible for them. If you are divorced, your marriage needed to have lasted 10 years, otherwise you are not eligible for spousal benefits.

Widow/widower benefits are vitally important to learn about. If you are currently widowed, regardless of your age at the time of your partners death, our best advice is to reach out to a professional. Generally, you are eligible for widow/widower benefits. The big takeaway with widow/widower benefits is that in virtually all cases, the bigger of the two checks stays. So for example if spouse A collects $2,000 a month, and spouse B collects $1,500 a month. If spouse A dies, spouse B collects $2,000 a month for as long as spouse B lives. There’s plenty more details than this, but the fact that the bigger of the two checks always stays is the big picture.